What Is The 401k Max Contribution For 2024. For those who are age 50 or over at any time during. Maximum salary deferral for workers:

In 2024, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older. After rising substantially from $20,500 in 2022 to $22,500 for 2023, mercer projects the annual cap to go up just $500 in 2024.

The Limit On Employer And Employee Contributions Is $69,000.

In 2024, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older.

Workplace Retirement Plan Contribution Limits For 2024.

Employees over the age of 50.

Each Year, The Irs Places Limits On The Maximum Amount Participants Can Contribute To Their 401 (K) Plans.

Images References :

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, In 2024, the contribution limit for 401(k) accounts is increasing by $500 to $23,000. The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Source: mint.intuit.com

Source: mint.intuit.com

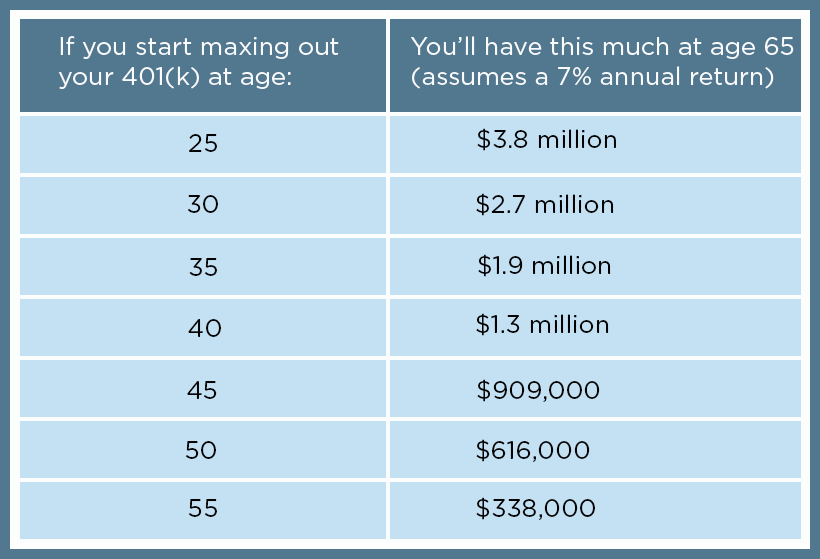

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, For 2024, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2023. The limit on employer and employee contributions is $69,000.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

401k Maximum Contribution Limit Finally Increases For 2019, Employees over the age of 50. In 2024, employees can contribute up to $23,000, tax deferred, to these plans.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, The contribution limits are high for 401(k) and 403(b) accounts. In 2024, employees can contribute up to $23,000, tax deferred, to these plans.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to. In 2024, the contribution limit for 401(k) accounts is increasing by $500 to $23,000.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, 401(k) contribution limits the 401(k) contribution limit for individuals has been increased to $23,000 for 2024. For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to.

Source: marquitawmagda.pages.dev

Source: marquitawmagda.pages.dev

How Much Can I Put In 401k In 2024 Adrian Eulalie, In 2024, the contribution limit for 401(k) accounts is increasing by $500 to $23,000. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit.

Source: streamgilit.weebly.com

Source: streamgilit.weebly.com

streamgilit Blog, Employers can contribute to employee. Workplace retirement plan contribution limits for 2024.

Source: cigica.com

Source: cigica.com

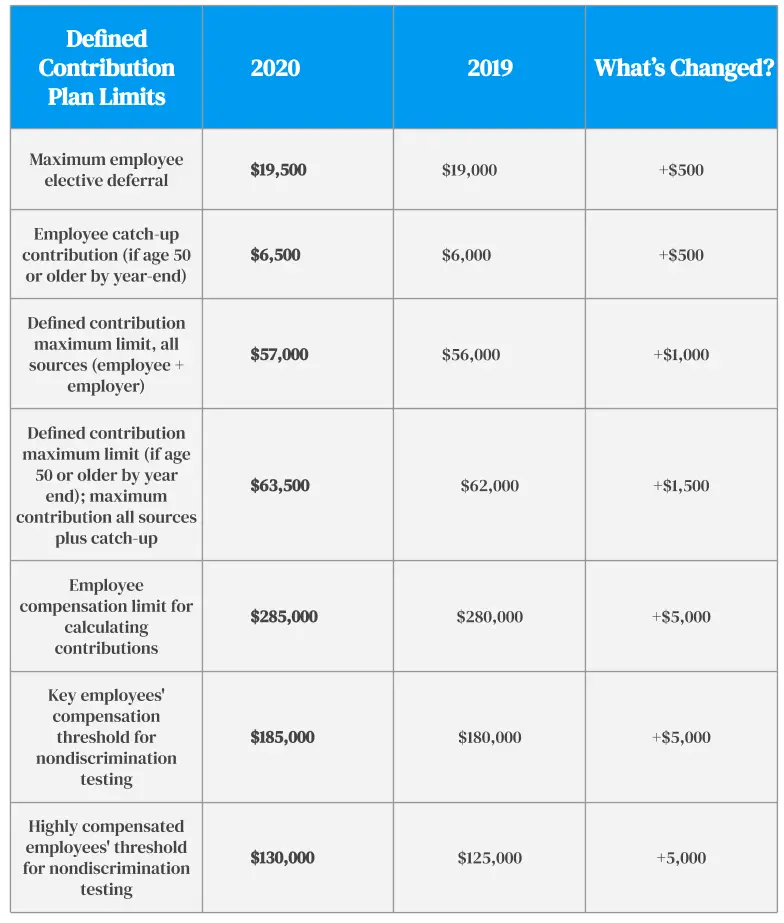

What Is The Maximum Employer 401k Contribution For 2020, Each year, the irs places limits on the maximum amount participants can contribute to their 401 (k) plans. In 2024, employers and employees together can.

Source: deidreqardelis.pages.dev

Source: deidreqardelis.pages.dev

402k Contribution Limits 2024 Danny Orelle, Employees over the age of 50. For those who are age 50 or over at any time during.

Maxing Out Your 401(K) Means Contributing Up To Your Annual Contribution Limit For The Year.

The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Workplace Retirement Plan Contribution Limits For 2024.

For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to.