Maximum After Tax 401k Contribution 2024. 401 (k) employee contribution limits. The 401 (k) contribution limits for 2024 are bigger than ever.

Each year, the irs determines the maximum that you and your employer can contribute to your roth 401 (k). Keep in mind that not all 401(k).

The Irs Limits How Much Employees And Employers Can Contribute To A 401 (K) Each Year.

As of november, the internal revenue service (irs) has announced adjustments to the contribution limits for 2024.

This Limit Rises To $30,000 For Those 50 And Older.

For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024.

In 2024, The 401 (K) Contribution Limit For Participants Is.

Images References :

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Specifically, for people under age 50 and those 50 or older, the irs has raised the bar on how much you can save. Understanding the basics of contribution limits.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, • 2mo • 3 min read. In 2024, the 401 (k) contribution limit for participants is.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, Plus, if you're 50 or older, you can contribute an. Retirement savers are eligible to put $500 more in a 401.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401k Contribution Limit Financial Samurai, After tax day, you can start investing for 2024. For 2024, employees may contribute up to $23,000.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, These accounts are popular retirement. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2023.

Source: www.approachfp.com

Source: www.approachfp.com

401(k) Max Contribution How it Works and FAQs, After tax day, you can start investing for 2024. The 2023 401 (k) contribution limit for employees was $22,500.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, The 401 (k) contribution limits for 2024 are bigger than ever. For 2024, the contribution limit to your 401(k) is $23,000, and this doesn't include any employer matching contributions.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

401(k) Contribution Limits & How to Max Out the BP Employee Savings, Specifically, for people under age 50 and those 50 or older, the irs has raised the bar on how much you can save. Keep in mind, however, that these limits apply to pre.

Source: www.harrypoint.com

Source: www.harrypoint.com

Employer 401(k) Maximum Contribution Limit 2023 43,500, 401 (k) employee contribution limits. These accounts are popular retirement.

Source: www.parksideadvisors.com

Source: www.parksideadvisors.com

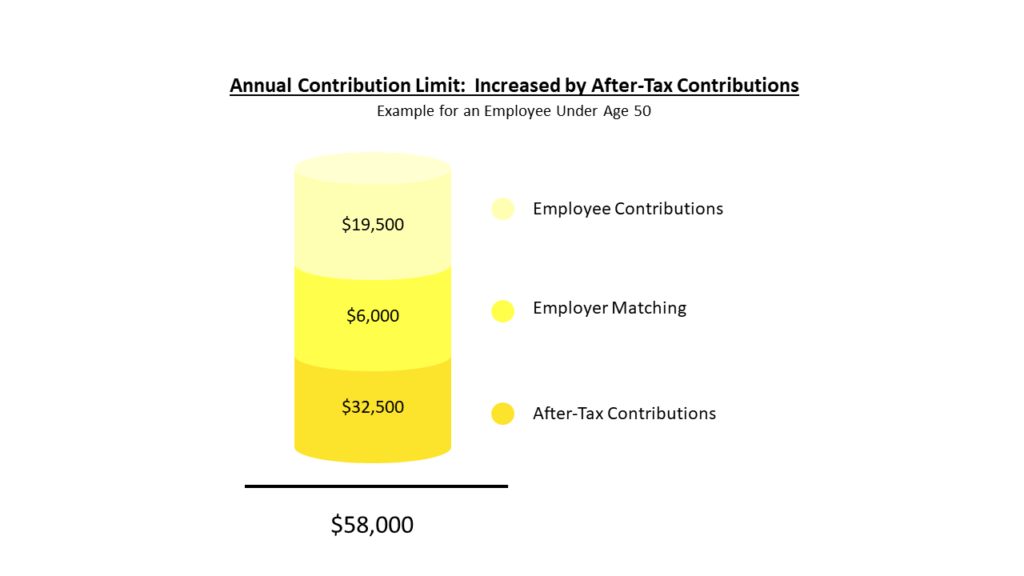

A Terrific Way to Increase Retirement Savings The AfterTax 401(k) Option, These accounts are popular retirement. If your employer offers a 401 (k) plan, try to.

In 2024, Those Limits Are $23,000 And $30,500, Respectively.

Keep in mind that not all 401(k).

The Maximum Contribution Limit For Traditional And Roth Iras Increased To $6,500 ($7,500 If You Are 50 And Over).

These accounts are popular retirement.