How Much Should I Withhold For Federal Taxes 2024. If you need to access the. So how much should you withhold in taxes?

See the tax rates for the 2024 tax year. This tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2024 tax year.

And When Should You Withhold An Additional Amount From Each Paycheck?

2024 us tax calculation for 2025 tax return:

In 2024, There Are Seven Federal Income Tax Rates And Brackets:

Itr filing without form 16:

Taxable Income And Filing Status Determine Which Federal Tax Rates Apply To You.

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, Federal withholding tax tables 2024 [updated], federal withholding tables determine how much money employers should withhold from employee wages for federal income tax. United states weekly tax calculator 2024.

50 Shocking Facts Unveiling Federal Tax Withholding Rates 2024, And when should you withhold an additional amount from each paycheck? United states weekly tax calculator 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. $0.00 (nan%) total payroll taxes:

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, Operates on a progressive tax system,. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

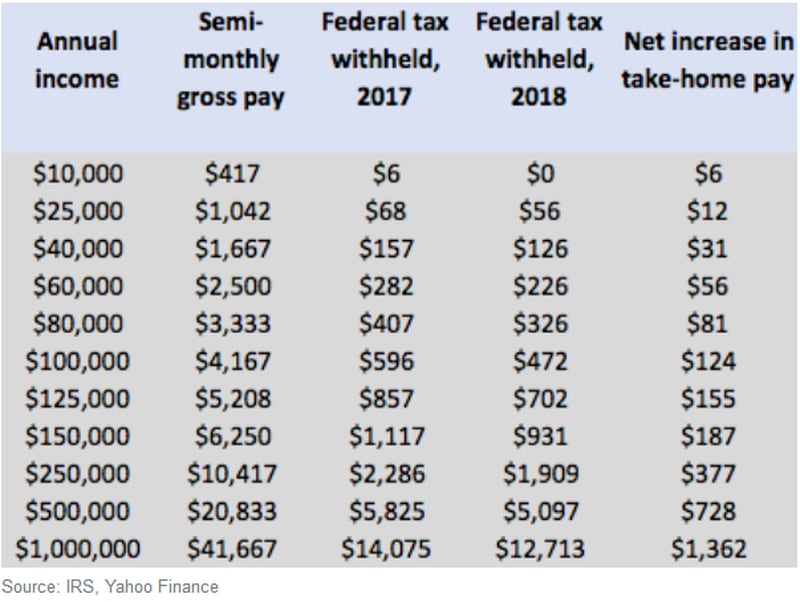

Source: www.springfieldnewssun.com

Source: www.springfieldnewssun.com

Here's why there's more money in your paycheck, We’ve been talking for more than an hour on. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Federal withholding tax tables A guide for 2023 QuickBooks, What are federal withholding tax. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2023 tax year, which are the taxes due in early 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Wage growth picked up in the. Effective tax rate 16.6% estimated federal taxes $14,260.

Source: payroll.utexas.edu

Source: payroll.utexas.edu

Calculation of Federal Employment Taxes Payroll Services The, Step by step irs provides tax inflation adjustments for tax year 2024 full. See the tax rates for the 2024 tax year.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

How Federal Tax Rates Work Full Report Tax Policy Center, So how much should you withhold in taxes? Operates on a progressive tax system,.

Source: bariqviviana.pages.dev

Source: bariqviviana.pages.dev

Federal Pay Raise 2024 Calculator Esta Olenka, Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. This form tells employers how much money to withhold from the employee's pay for federal income tax.

The Table Below Shows The Tax Brackets For The Federal Income Tax, And It Reflects The Rates For The 2023 Tax Year, Which Are The Taxes Due In Early 2024.

Wage growth picked up in the.

Effective Tax Rate 16.6% Estimated Federal Taxes $14,260.

If you need to access the.