401k Max Employer Contribution 2024. 401 (k) and roth contribution limits:. Maximum 401(k) contribution limits for 2024.

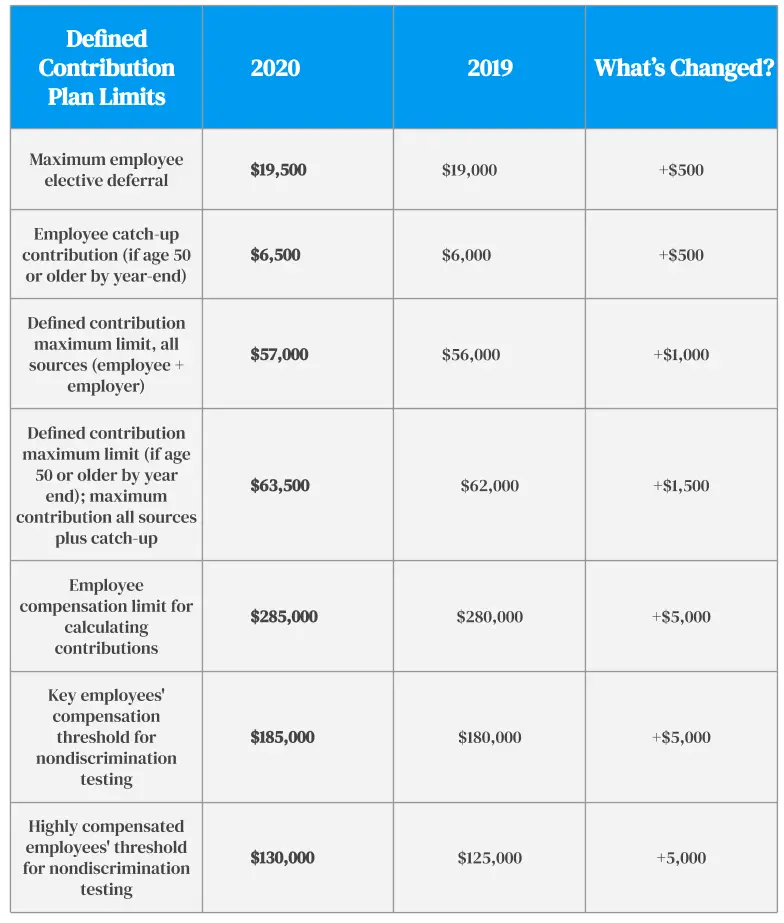

The total maximum that can be tucked away in your 401(k) plan, including employer contributions and allocations of forfeiture, is $76,500 in 2024, or $7,500 more than the $69,000. In 2024, employers and employees.

The 2024 401(K) Individual Contribution Limit Is $23,000 , Up From $22,500 In 2023.

401 (k) contribution limits for 2024.

401 (K) And Roth Contribution Limits:.

The 2024 401(k) contribution limit is $23,000 for people under 50, up from $22,500 in 2023.

For Tax Year 2024 (Filed By April 2025), The Limit Is $23,000.

Images References :

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can. Irs max 401k contribution 2024.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, $23,000 (up $500 from 2023) 457(b) contribution limit: Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2023 and 2024.

Source: cigica.com

Source: cigica.com

What Is The Maximum Employer 401k Contribution For 2020, For senior workers aged above 55 to 65, the total cpf contribution rates will be increased by 1.5% from 1 january 2025, inclusive of a 0.5% increase. For 2024 you may contribute up to $23,000 to your employer's 401(k) plan.

Source: amandyqmartha.pages.dev

Source: amandyqmartha.pages.dev

Irs 401 K Contribution Limits 2024 Angele Colline, In 2024, employers and employees. For 2024 you may contribute up to $23,000 to your employer's 401(k) plan.

Source: db-excel.com

Source: db-excel.com

401K Projection Spreadsheet regarding The Maximum 401K Contribution, $23,000 (up $500 from 2023) 457(b) contribution limit: Irs max 401k contribution 2024.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, The 401(k) contribution limit is $23,000. 401 (k) and roth contribution limits:.

Source: uglybudget.com

Source: uglybudget.com

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, In 2024, employers and employees. The 2024 401(k) individual contribution limit is $23,000 , up from $22,500 in 2023.

Source: sheetsforinvestors.com

Source: sheetsforinvestors.com

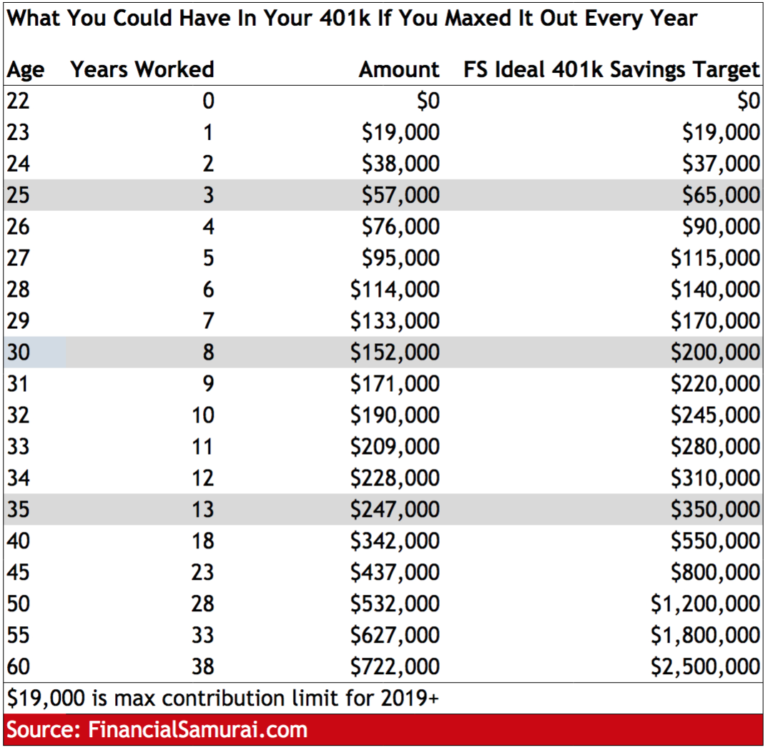

Free 401(k) Calculator Google Sheets and Excel Template, Employees can invest more money into 401(k) plans in 2024, with contribution limits increasing from $22,500 in 2023 to $23,000 in 2024. The 2024 401(k) contribution limit is $500 higher than this year’s $22,500 max, which reflected a.

Source: merrilywdahlia.pages.dev

Source: merrilywdahlia.pages.dev

401K Limits 2024 Stefa Emmalynn, In 2024, employers and employees. Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2023 and 2024.

Source: www.betterup.com

Source: www.betterup.com

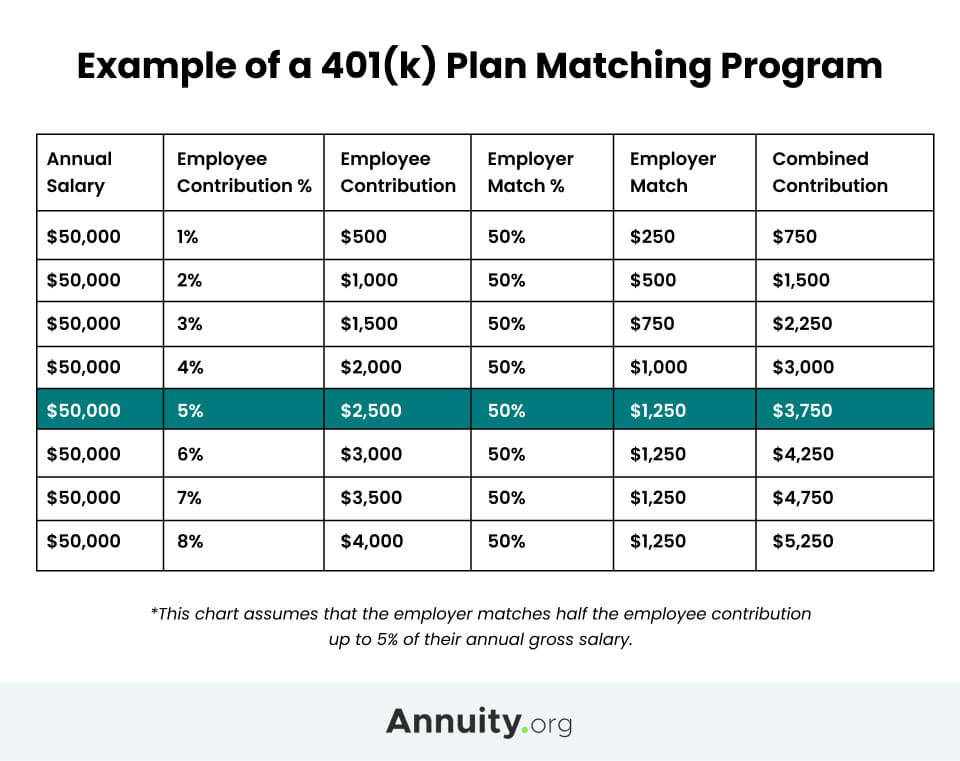

What 401(k) Employer Match Is and How It Works in 2023, 401 (k) and roth contribution limits:. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum.

The 2024 401(K) Individual Contribution Limit Is $23,000 , Up From $22,500 In 2023.

Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2023 and 2024.

$23,000 (Up $500 From 2023) 457(B) Contribution Limit:

Specifically, for people under age 50 and those 50 or older, the irs has raised the bar on how much you can save.