2024 Ira Contributions Irs. The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

For 2023, the contribution limit is $6,500, or $7,500 if you’re 50 or over. This is an increase from 2023, when the limits were $6,500 and $7,500,.

2024 Ira Contributions Irs Images References :

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, Know about both roth and traditional ira limits.

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2024 Charitable Contribution Limits Irs Linea Petunia, For individual retirement accounts, or iras—both roth and traditional types—2024 contributions will max out at $7,000, up.

Source: loreeaugusta.pages.dev

Source: loreeaugusta.pages.dev

2024 Max Roth Ira Contribution Elset Katharina, Get information about ira contributions and claiming a deduction on your individual federal income tax return for the amount you contributed to your ira.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

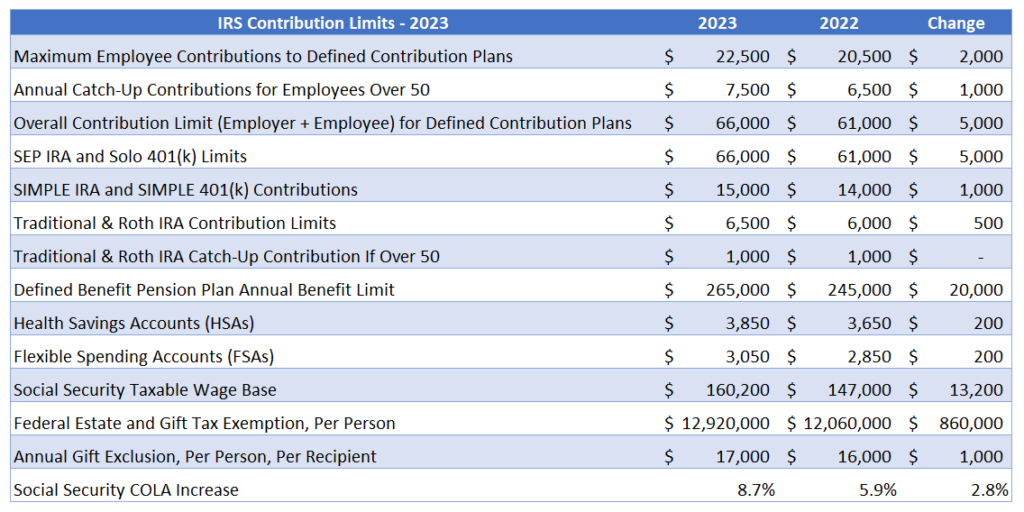

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, For both traditional and roth iras, you can contribute up to $7,000 for 2024, up from $6,500 in 2023.

Source: ryannqtheresa.pages.dev

Source: ryannqtheresa.pages.dev

Irs 2024 Ira Limits Claire Sheilah, For both traditional and roth iras, you can contribute up to $7,000 for 2024, up from $6,500 in 2023.

Source: headtopics.com

Source: headtopics.com

IRS announces 2024 retirement account contribution limits 23,000 for, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Source: cassaundrawmaria.pages.dev

Source: cassaundrawmaria.pages.dev

Irs 403b Contribution Limits 2024 Jenny Lorinda, What is the limit for roth ira contributions in 2023 and 2024?

Source: aleneqjenifer.pages.dev

Source: aleneqjenifer.pages.dev

Irs Tax Deferred Contribution Limits 2024 Thea Abigale, Review a table to determine if your modified adjusted gross income (agi) affects the amount of your deduction from your ira.

Source: linabrittni.pages.dev

Source: linabrittni.pages.dev

2024 Hsa Contribution Limits Over 55 Over 60 Dollie Sylvia, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Source: risakorella.pages.dev

Source: risakorella.pages.dev

2024 Max Roth 401k Contribution Limits Jess Romola, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Posted in 2024